Climate Change Response

Recognition of the External Environment

As climate change accelerates, various impacts and damages are beginning to appear on the natural environment, people's lives, and corporate activities in various regions of the world. With the adoption of the Paris Agreement as a measure to address climate change, countries are taking measures to achieve net zero emissions, and the Japanese government has announced that it will raise its NDC target (greenhouse gas (GHG) reduction target for FY2030) from 26% to 46% (compared to FY2013). And, companies are expected to contribute to a decarbonized society through their business activities.

As a company, we aim to achieve sustainable growth while mitigating and adapting to climate change through our own operations. In addition, we recognize the importance of information disclosure, as there are increasing demands for companies to disclose information on climate-related issues.

Policy

We recognize that climate change is both a risk and an important management issue that will lead to new profit opportunities for our company. We believe that actively and proactively addressing climate change will enhance our corporate value over the medium to long term, and we aim to benefit not only ourselves but also society as a whole through appropriate collaboration with our stakeholders. Through these efforts, we aim to contribute to the achievement of the goals set forth in the SDGs and the Paris Agreement.

We recognize the importance of climate-related financial disclosures and are committed to disclosing information in accordance with the TCFD recommendations.

Governance

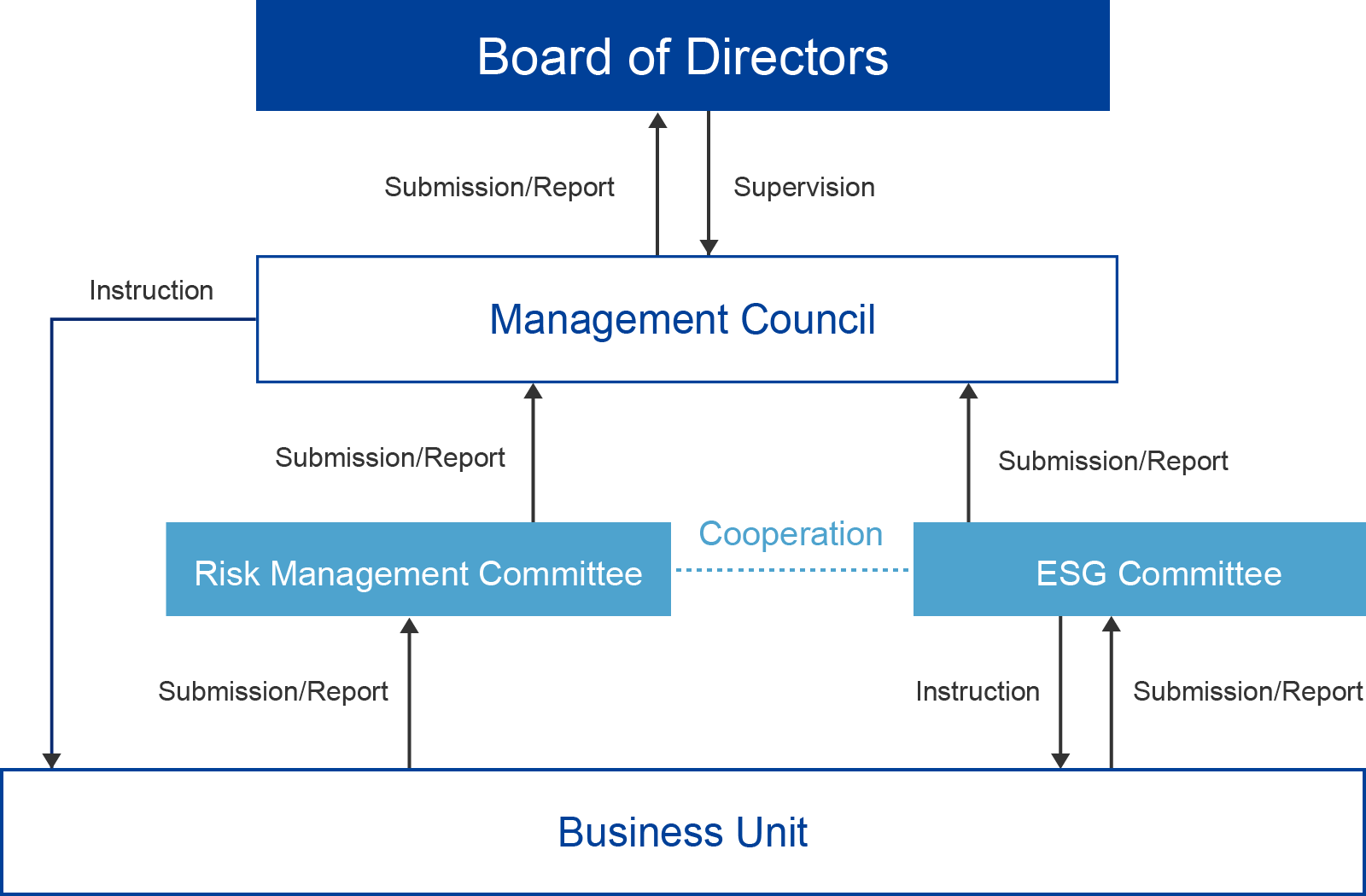

The diagram below illustrates our governance structure regarding climate change.

Supervisory system of directors

The Board of Directors receives reports from the Executive Committee on a regular basis (in principle twice a year) on important climate-related matters, including the progress of transition plans and adaptation measures, and reviews and directs the company's strategies, business plans, risk management policies, etc., and oversees the progress against indicators and targets to address climate-related issues.

Role of management

The President and Representative Director is responsible for the company's management in climate-related matters. This responsibility includes the assessment and management of climate-related matters.

The Management Council (*1), chaired by the President and Representative Director, receives reports from the ESG Committee (*2) on the results of its deliberations (in principle, four times a year) for monitoring purposes. The management council deliberates and decides on the company's strategies, business plans, risk management policies, etc., taking into account the progress of climate-related initiatives included in the reports.

(*1) Management Council

In accordance with the "Management Council Regulations", the Management Council is convened by the President, who chairs the meeting, and is composed of full-time directors, full-time corporate auditors, and other members added at the direction of the President, and is held once or twice a month.

ESG Committee

The ESG Committee (*2) deliberates on climate-related matters as one of the sustainability issues. The ESG Committee (*2) meets regularly (four times a year, in principle) under the direction of the Management council. The E, S, and G subcommittees identify issues, set targets and action plans, monitor progress, and discuss and evaluate measures to address identified risks and opportunities in cooperation with the Risk Management Committee. The committee then submits important matters to the Risk Management Committee for deliberation and reporting.

(*2) ESG Committee

We have positioned ESG perspectives at the core of our management, and in order to achieve medium- to long-term "enhancement of corporate value" through ESG management. We have established the ESG Committee as an organization to formulate company strategies, policies, and action plans regarding ESG and sustainability, and to evaluate and promote their implementation. The ESG Committee is chaired by the president, vice-chaired by a director, and consists of the general managers of each department, outside directors, and full-time corporate auditors (10 members in total).

Strategy

We identified climate-related risks and opportunities for our business and considered their impact on our business under selected scenarios, in terms of transition and physical risks and opportunities, following the TCFD framework and identifying each as described below. After identifying risks and opportunities, we tested our resilience under multiple scenarios from two axes: the axis of "development of low-carbon product markets" and the axis of "development of decarbonization policies".

Process for identifying risks and opportunities

Based on internal assessment criteria, we evaluate possible risks and opportunities related to climate matters and identify those that are significant. In identifying them, we take into account their financial impact and the timeframe established.

Scenario analysis...selected scenarios and time frames and reasons for scenario selection

In selecting the scenarios, We have chosen the WEO NZE 2050 scenario (1.5℃ scenario) developed by the International Energy Agency (IEA) that are consistent with the Paris Agreement, i.e., with the goal of limiting the increase the temperature to 1.5℃ above pre-industrial levels in global average. That are also consistent with the NDC submitted by Japan on October 22, 2021 (an ambitious goal consistent with carbon neutrality in 2050, which aims to reduce greenhouse gas emissions by 46% from 2013 levels in FY2030).

In addition, as a scenario opposite to the above scenario, we selected IPCC RCP8.5 (4℃ scenario), in which the goal of "limiting the increase temperature to 1.5°C above pre-industrial levels in global average" and Japan's NDC are not achieved and the highest average temperature is reached. We attempted to analyze these two scenarios from various perspectives, such as how our business would be affected and how much financial impact we would incur by taking countermeasures.

-

WEO NZE 2050 scenario (1.5℃ scenario)

- Carbon pricing is strengthened, resulting in higher manufacturing costs.

- Requests from our stakeholders for GHG emission reductions will increase.

- Demand for environmentally friendly electronic components such as smart and that for EVs in automobiles and storage batteries will increase.

- DX will advance in order to promote the transition to a low-carbon economy, and demand for electronic components and semiconductors will increase accordingly.

- Demand for low-carbon products will expand rapidly, and technological innovation related to low-carbon products will advance.

- The frequency and severity of typhoons, floods, and storm surges will remain the same worldwide as at present, and the impact on grain-derived raw materials will also remain the same as at present.

-

IPCC RCP 8.5 (4℃ scenario)

- Carbon pricing will be introduced, but cost increase in manufacturing will be limited.

- GHG emission reduction requests from our stakeholders will remain at the same level as the current situation.

- Electrification will progress in some areas, and demand for EVs and storage batteries will increase slightly.

- The demand for electronic components and semiconductors will remain at the same level as the current situation.

- The demand for electronic components and semiconductors will remain at the same level as the current level.

- The cost of various raw materials will increase due to the difficulty of stable procurement as a result of frequent abnormal weather, crop failures, and the effects of mining of noble metals.

| Chosen scenario | Identified risks/opportunities | Driver | period | Extent of Impact | Countermeasure | |

|---|---|---|---|---|---|---|

| Type | Overview | |||||

| 1.5℃ Scenario IEA NZE 2050 |

Transition Risk (Policies and Regulations) |

Strengthen GHG emission regulations and carbon taxes | GHG emission regulations / carbon taxes |

long term | Barely | Environmental investment measures such as company-wide LEDs, replacement of air conditioners, replacement of EVs, etc. |

| Transition Risk (Reputation) |

Requests from stakeholders to reduce GHG emissions | Requests from stakeholders to reduce GHG emissions | long term | a little more | ESG Committee promotes development of products that contribute to the environment, environmental investment measures, scenarios, risk and opportunity analysis, etc., and discloses them as sustainability information. | |

| Opportunities (Products/Services/Markets) |

Developing products that are nickel-free processes | Requests from stakeholders to reduce GHG emissions | short term, mid-term, long term | much | Implementing capital investment that can quickly respond to individual customer requirements and specifications, participating in exhibitions, etc. | |

| Opportunities (Markets) |

Entering the battery market | Government-led investment promotion measures | mid-term, long term | much | Seeking joint development, etc. with battery material and electrolyte manufacturers to launch a business model in the rechargeable battery field by 2030 | |

| 4℃ Scenario IPCC RCP8.5 |

Physical risk |

(Acute) Damage to production sites caused by typhoons and floods. |

Frequency and severity of typhoons and floods | long term | Barely | We view this as an acceptable risk and consider no countermeasures (investment) necessary. |

| (Chronic) Increase in average temperature |

Average temperature | long term (5 to 35yrs) | same as above | |||

| Physica risk (Acute) |

Damage to our customers' factories (both domestic and overseas) due to cyclones and floods | Frequency and severity of cyclones and typhoons | long term | much | Re-planning by incorporating relevant risks, geopolitical risks into the Company's BCP | |

| Opportunities (Products/Services/Markets) |

Development of alternative products to grain-derived raw materials | Abnormal weather | mid-term, long term | mid to much | Aim to replace at least 20% of key raw materials by 2030 through two approaches: new product development and improvement of existing products. | |

Chosen scenario ・WEO NZE 2050 scenario developed by the International Energy Agency (IEA)

・RCP 8.5 scenario developed by the Intergovernmental Panel on Climate Change (IPCC)

Period:short term: 1year (Same period as single-year plan), mid- term: 3years (Same period as mid-term management plan),

long term: 2030 (Same period as mid-term target in Japan's NDC)

Scenario analysis results

Under the IEA NZE2050 scenario, which is assumed to pose a higher transition risk, the introduction of GHG emission regulations and carbon pricing is expected to result in additional costs in manufacturing, and stakeholders, including our customers, are expected to increase their requests for us to reduce our GHG emissions.

In addition, since our customers are expected to demand reductions in energy consumption, we see an opportunity to expand sales of our nickel-free products (which eliminate the need to use electricity for the nickel plating process). Furthermore, since demand for storage batteries is expected to increase, we believe that this is an opportunity for us to apply the core technologies we have cultivated in plating to develop elements for storage batteries, thereby creating a new source of earnings.

Under the IPCC RCP8.5 scenario, in which physical risks increase, the frequency and severity of typhoons and floods are expected to increase. However, we do not anticipate any risk of production capacity shutdowns or reductions due to the disaster because the location of our head office (35.5m above sea level with no water source in the surrounding area) does not pose such a physical risk. On the other hand, there is a risk that our customers may be damaged by typhoons or floods, especially those with factories overseas, and this risk may materialize, resulting in a decrease in our sales.

In addition, crop failures are expected due to abnormal weather conditions. Since the main raw materials of our plating chemicals are grain-derived, a poor grain harvest could result in a sharp rise in raw material prices, but we have begun developing alternative raw materials to grain-derived raw materials. This development will not only reduce our risk of raw material price hikes, but will also meet the needs of our customers who wish to reduce their impact on the environment, and we believe that this will increase our sales to these customers.

Our resilience to climate change-related risks

In the "Sustainability Management Initiatives" section of our Mid-term Management Plan, we have set forth our commitment to contribute to the realization of a sustainable society by responding sensitively to environmental changes and promoting fair corporate activities, and have formulated E, S, and G targets and specific initiatives. This includes measures to address climate change-related risks. Please refer to the table above for details.

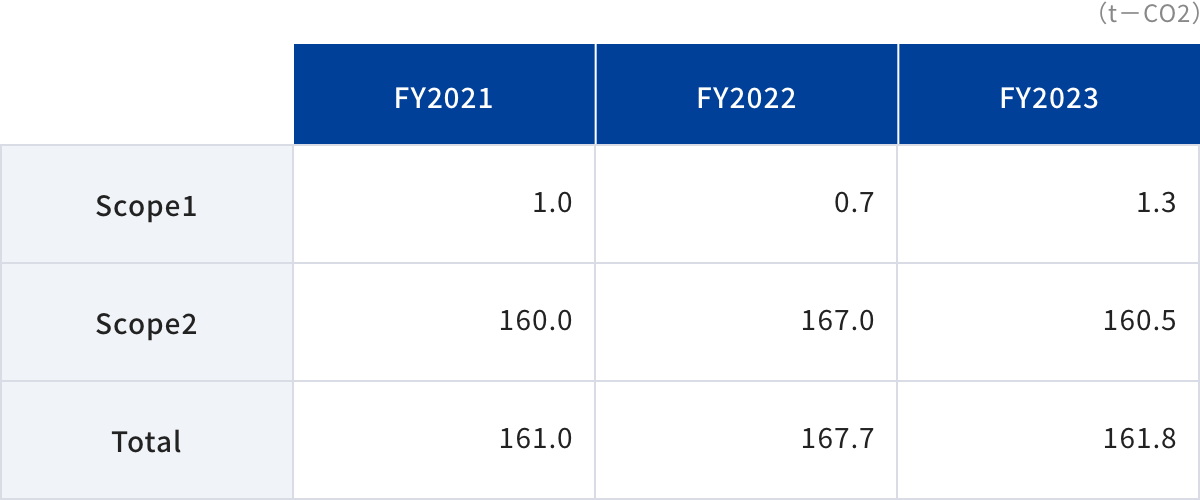

In the scenario with accelerated transition risk (WEO NZE 2050 scenario), we assume that the demand to reduce GHG emissions will increase. Since our GHG emissions (Scope 1 and 2) are very small, the impact on our manufacturing costs will be very limited, and our efforts to reduce GHG emissions by saving energy and introducing renewable energy. This is not only a cost reduction measure, but also an effort toward the transition to a low-carbon society, which is demanded by our stakeholders. In addition, we believe that this is not only an opportunity to expand sales of our nickel-free products, but also to promote the development of storage battery elements in line with our vision RDD2030 "Applying Redox technology to a battery material" set forth in our medium-term management plan. These efforts will also contribute to the transition to a low-carbon society demanded by our stakeholders.

On the other hand, despite the risks assumed in the scenario of increased physical risks (IPCC RCP8.5), we rather see this as an opportunity for us to develop alternative raw materials to grain-derived raw materials.

Risk Management

Methods of identifying climate-related risks

The E Subcommittee of the ESG Committee is in charge of climate-related matters and works with relevant internal departments to assess climate-related risks. Climate-related risks are reported from the E Subcommittee to the ESG Committee, which deliberates and determines climate-related risks. The ESG Committee then reports the risks to the Management Council, which deliberates and approves them before finally identifying them as climate-related risks for the Company.

In addition, the following items are considered in the ESG Committee's deliberations.

- Existing and new regulatory requirements (e.g., carbon price)

- Short-, medium-, and long-term period

- Transition risk: policy and regulatory risk, technology risk, market risk, reputation risk, etc.

- Physical risk: acute risk, chronic risk

Method of determining materiality

We evaluate and determine the significance of climate-related risks by considering the following items

- Urgency (probability of occurrence)

- Financial impact

Management process for climate-related risks

- How to address risks

The identified climate-related risks are reviewed by the Risk Management Committee for mitigation, transfer, acceptance, and control. The Risk Management Committee reports the results of its deliberations to the Management Council, which ultimately decides how to respond to the risks. - Developing priorities

The Risk Management Committee determines the ranking of climate-related risks to be prioritized by the Company. In doing so, each is evaluated and prioritized from two perspectives: potential financial impact and urgency (probability of occurrence).

Integration into company-wide risk management

The Risk Management Committee meets regularly (in principle four times a year) to evaluate the Company's risks reported by each department, identify Company-wide risks, deliberate on appropriate responses, and report to the Management Council.

Issues related to our sustainability management, such as climate change and human capital and diversity, are reported from the ESG Committee to the Risk Management Committee, which evaluates them, identifies the risks, discusses appropriate responses, and reports to the Management Council.

Finally, the Management Council determines the company-wide risk management policy, and the department in charge of risk management manages risks based on the policy.

Indicators and Targets

Metrics used to measure and manage climate-related risks and opportunities

We use the following indicators to measure and manage climate-related risks and opportunities

- GHG emissions (Scope 1 and Scope 2)

- Percentage of renewable energy

- Regulatory Risk: Carbon price

- Opportunity: Rate of increase in revenue from products or services that support the transition to a low-carbon economy

Internal carbon price

Our GHG emissions in the conduct of our business are very small, and we have developed a business model in which increases and decreases in combustion energy inputs are not linked to changes in our business performance. Therefore, even if energy prices were to rise several times in the future, the financial impact on our company would be minimal and have little effect on our business plan. On the other hand, we believe that developing an Internal Carbon Price and considering climate-related risks and opportunities would be beneficial thinking of our customers' situation entering the low-carbon product market.

The Internal Carbon Price is set in conjunction with the latest J-Credit price (for renewable energy generation) and is used as the basis for our investment decisions.

CO2 per ton: 3,000 yen (based on the latest J-Credit price (renewable energy generation): as of April 2022)

GHG emissions

Our GHG emissions are as follows.

Targets and indicators against targets

We have established the following goals to mitigate and adapt to climate-related risks and maximize climate-related opportunities. We have also developed the following indicators for each of them.

Target 1: Reduce GHG emissions

Goal: Achieve carbon neutrality with respect to Scope 1 and 2 by 2030

Indicator: GHG emissions

Target 2: Energy consumption (energy conservation, etc.)

Goal: 20% reduction in energy consumption in FY2030 (compared to FY2022)

Indicator: Energy consumption