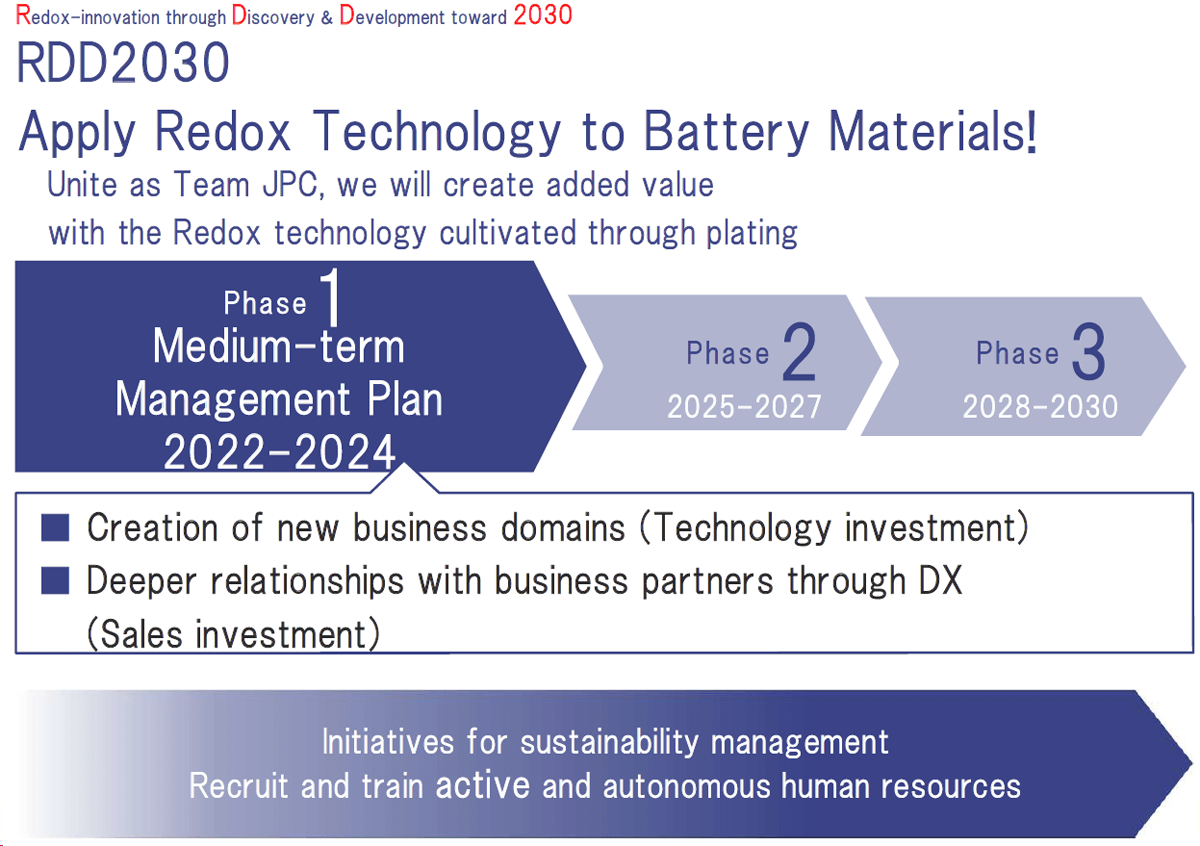

RDD2030 is the roadmap of our Medium-Term Forecast. This is divided into three phases from FY 2022 to FY 2030 (FY 2022 to FY 2024: Phase 1, FY 2025 to FY 2027: Phase 2, and FY 2028 to FY 2030: Phase 3). Redox technology cultivated through plating will be used to create added value and achieve the goal of "Redox technology as a battery material! Redox technology for battery materials! To achieve this goal, we are investing in technology to create new business areas and in sales and marketing to deepen our business partners' relationships with them through DX. Although we revised our Medium-term Forecast due to the slow recovery of the market in the first phase, we aim to achieve our medium-term ROE target of 10% by returning to the growth path as soon as possible without delaying the recovery of the market.

Medium-Term Business Forecast FY2022-2024

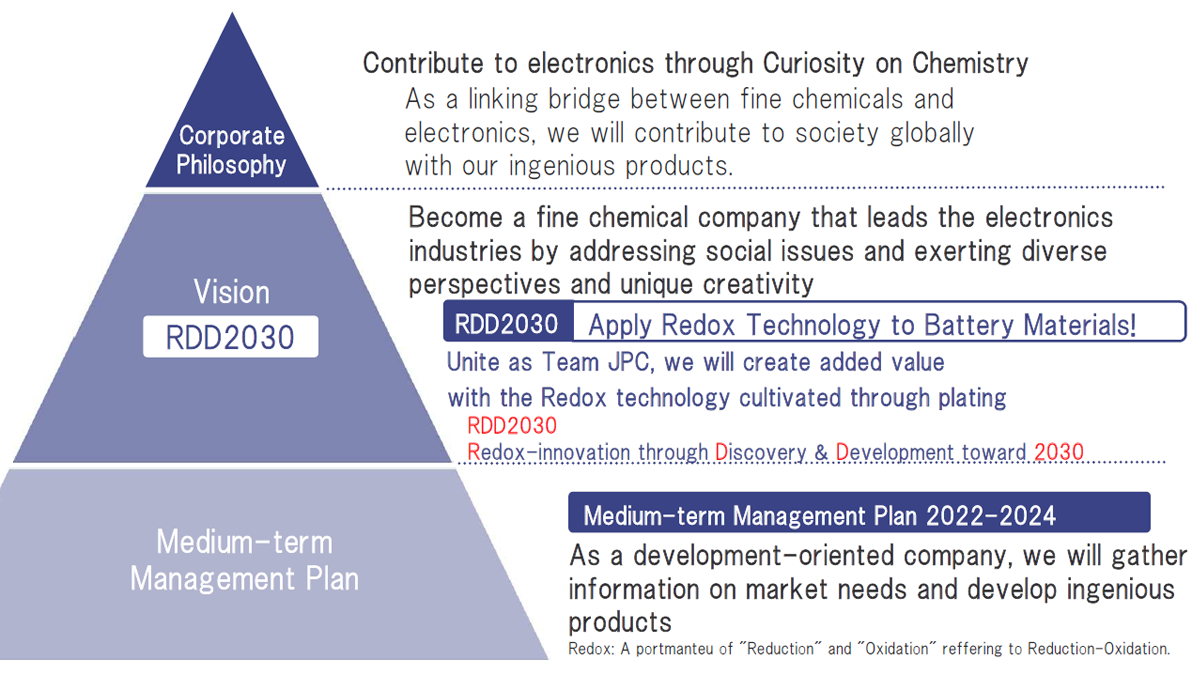

Corporate Philosophy and Vision

Road Map

New development measures in existing areas

1. Promotion of Company name

Utilize exhibitions, advertisements, etc. to increase recognition in low-profile markets in Japan and overseas.

2. Proposal of environmentally friendly products

Proposal for cyanide and toxic substance-free and resource-saving process

3. Proposal to improve performance in total process

Collaboration improves performance of the total process, including equipment, pretreatment, and post-treatment

Sustainability Policy and Structure

Basic Sustainability Policy

Under our corporate philosophy of "Using the curiosity of chemistry to benefit electronics," we aim to build a bridge between fine chemicals and electronics by addressing social issues such as global environmental risks, lifestyle changes, and energy shifts, while deepening cooperation with stakeholders and demonstrating our diverse perspectives and originality. We aim to be a bridge between fine chemicals and electronics.

In addition, as a Manufacturing company that uses noble metals and rare minerals and handles a large number of Chemicals, it is essential for us to consider the global environment. We will continue to reduce our environmental impact by conducting our business activities based on the premise of making effective use of resources and contributing to the creation of a sustainable society.

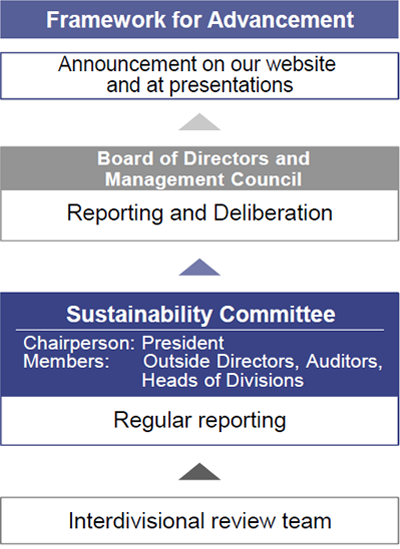

Promotion Structure

Materiality

Based on the Basic Sustainability Policy, we have identified four issues (materiality) that we consider important from the three perspectives of environment, society, and governance.

Environmentally friendly manufacturing products

Human Capital Management Promotion of

Intellectual Intangibles Qualitative improvement of

Strengthening of Management Base

Sustainability

Targets (Current status of Medium-term Management Plan)

Get back to a growth track promptly with market recovery trend, and achieve medium- to long-term ROE target of 10%

Financial Policy (Progress of Plan)

- Generate ¥2.5 billion in operating CF for 3 years by stable performance and allocate to invest in existing businesses and to stable shareholder returns.

- Utilize ample cash on hand and reducing of specified investment shares for medium- to long-term growth investments

Shareholder Return Policy (after DOE adoption)

Basic Policy (FY2022-2024)

- Balancing capital efficiency and financial soundness for long-term growth

- As a prime market listed company, actively engage in a certain level of shareholder return that is not greatly influenced by current business performance

- Adopt a dividend policy with a minimum DOE (dividend on equity ratio) of 5% in addition to the dividend payout ratio

- In the course of optimizing the capital adequacy level, revise the calculation method of capital-related indicators (ROE, DOE) from the conventional shareholders' equity-based method to an equity-based method.

- Consider implementing share buybacks in a flexible manner, depending on the situation.

Dividend payout ratio, share buybacks, and total return ratio