Basic Concept

Strengthening of Management Base

The Company's basic approach to corporate governance is to respond to changes in the business environment and aim for continuous improvement of corporate value by making transparent, fair, prompt, and decisive decisions in consideration of the standpoints of shareholders, customers, employees, local communities, and other stakeholders. Based on this concept, the Company is working to speed up management decision-making and clarify management and business execution responsibilities, while strengthening management supervisory functions, compliance, risk management, and internal control systems under a Board of Directors and Board of Corporate Auditors that include highly independent outside officers.

Corporate Governance Report (Japanese only)

Corporate Governance Structure

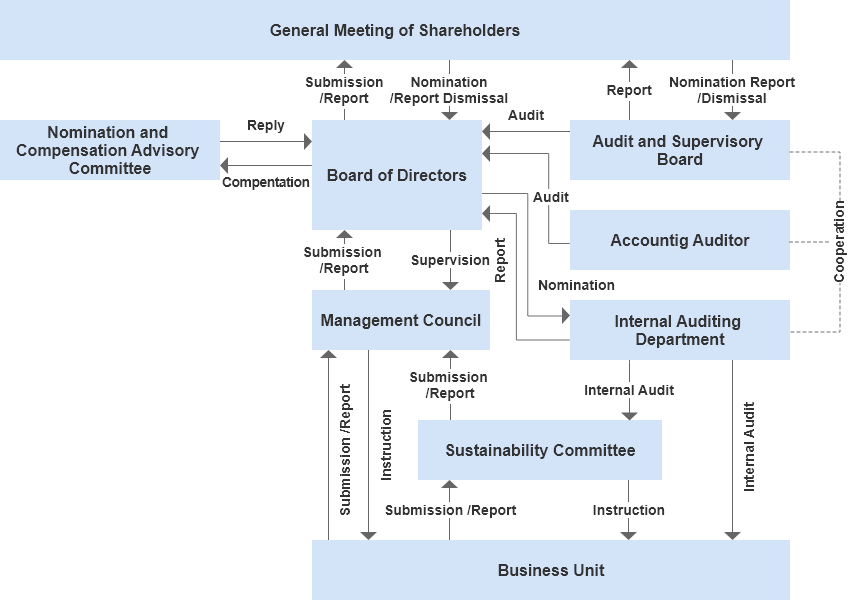

Our Corporate Governance Structure

- The Board of Directors, consisting of three directors with extensive knowledge of the Company's business and three highly independent outside directors, deliberates and decides on important matters related to the execution of business operations, including matters related to the Company's Forecast. Once a year, a questionnaire on the effectiveness of the Board of Directors is distributed to all directors and corporate auditors, and the answers are used to analyze and evaluate the effectiveness of the Board.

- The Board of Corporate Auditors consists of three members, including two outside corporate auditors. The corporate auditors audit the legality of the execution of duties by the directors independently from the directors.

- The Nomination and Remuneration Advisory Committee was established as an advisory body to the Board of Directors for the purpose of establishing a system in which independent outside directors are appropriately involved in decision-making regarding director nominations and remuneration, enhancing the objectivity and transparency of the decision-making process, and further improving corporate governance. Its main role is to respond to the Board of Directors' consultations regarding the election and dismissal of directors and corporate auditors, the selection and dismissal of representative directors and directors with special titles, and the compensation of directors.

Board of directors

The Board of Directors consists of six directors, three of whom are outside directors, half of whom are outside directors from the viewpoint of strengthening corporate governance (as of June 25, 2024). The Board of Directors meets once a month in principle, and also meets as needed when urgent decisions are required. The Board is responsible for making important decisions regarding the execution of the company's business, including matters related to the Management Forecast, as well as supervising the overall execution of business operations.

The Company's Articles of Incorporation stipulate that the Company shall have no more than 10 Directors. In addition, the term of office of directors is set at one year in order to clarify management responsibility for each FY.

Board of Corporate Auditors

The Company has adopted a corporate auditor system. Corporate auditors audit the legality of the execution of duties by directors independently from directors. In addition to monthly meetings in principle, the Board of Corporate Auditors holds meetings as needed. The Company has one full-time and two part-time outside corporate auditors (as of June 25, 2024).

Management Meetings

The Management Committee, consisting of internal directors, full-time corporate auditors, and the heads of each department, reports and deliberates mainly on the Company's management policies and strategies, as well as on the status of business execution, including budget progress. Important matters are deliberated thoroughly in advance by the Management Committee before being brought to the Board of Directors, thereby ensuring the fullness and appropriateness of deliberations in the decision-making process.

Any committee (as of June 25, 2024)

Nomination and Remuneration Advisory Committee

The Nomination and Remuneration Advisory Committee has been established as an advisory body to the Board of Directors. The Committee's main roles are to consult with the Board of Directors regarding the election and dismissal of Directors and Corporate Auditors, the selection and dismissal of Representative Directors and Directors with special titles, and the remuneration of Directors. The Committee consists of four outside directors and one internal director, with the outside director elected by mutual vote as the Committee's chairman and the officer in charge of the Corporate Planning Department serving as Secretariat (as of June 25, 2024).

The Board of Directors met 11 times during FY and made recommendations to the Board of Directors regarding the management structure and other matters based on diversity, and also determined the amount of individual compensation (monetary compensation and stock compensation) for Directors based on the resolution of the Board of Directors.

Main Items for Discussion

- Determination of monthly monetary compensation for individual directors

- The structure of the Company's Board of Directors in light of the diversity and skills matrix

- Selection of Candidates for the Next Board of Directors (Directors, Corporate Auditors, and Alternate Corporate Auditors)

- Discussion on the revision of the executive compensation system

Sustainability Committee

We have positioned our Basic Sustainability Policy at the core of our management and will contribute to the realization of a sustainable society by responding sensitively to environmental changes and promoting fair corporate activities.

The ESG Committee was established in June 2022 as an organization to compile corporate governance, risk management, strategies, indicators and targets related to ESG and sustainability for the purpose of achieving medium- and long-term "enhancement of corporate value" through sustainability management, ensuring that directors and employees perform their duties in compliance with laws and regulations and the Articles of Incorporation, and managing the risk of loss. The ESG Committee was established in June 2022 as a body to formulate an Action Forecast, manage and evaluate its progress, and in August 2023 was reorganized as the Sustainability Committee, integrated with the existing Risk Management Committee, and began operations. The Sustainability Committee consists of nine members, including the President and Representative Director (chairperson), the director in charge of risk management, the heads of each department, and the Corporate Auditors and Internal Audit Office (for guidance and advice as needed) (as of June 25, 2024).

In the fiscal year ended March 31, 2024, the Group met four times and worked on Forecasting and implementation of sustainability management activities, mainly on the themes of climate change and non-financial information in the form of human capital, as well as on information security measures, BCP development, safety management in the manufacturing sector, digitization of R&D data, and compliance with stricter laws and regulations. We also worked on information security measures, BCP development, safety management in manufacturing divisions, digitization of R&D data, and compliance with strengthening laws and regulations.

Board of directors

Policy regarding the balance of skills, etc. of the Board of Directors as a whole and the appointment of directors

In order for the Board of Directors to fulfill its functions, the Company has long been selecting candidates for the Board of Directors and seeking shareholder approval at the General Meeting of Shareholders in order to secure as much as possible an appropriate combination of knowledge, experience, and ability as well as years in office that the Company deems necessary. In making the selection, the Company identifies the skills, etc. that the Board of Directors should possess in light of the Company's medium- to long-term management direction, etc., and discloses the combination of skills, etc. possessed by the Company's officers by using a skills matrix in the convocation notice of the General Meeting of Shareholders.

Activities of the Board of Directors (53rd fiscal year: April 1, 2023 to March 31, 2024)

*The difference in the number of times is due to the difference in the time of inauguration.

Board of Directors Considerations

In FY 2011, in accordance with the requirements of the Tokyo Stock Exchange and the Corporate Governance Code, we focused our discussions on "measures to realize management that is conscious of the Cost of Capital and stock price. In particular, we had active discussions, incorporating the opinions of outside experts, on growth strategies for business expansion, the reduction of policy shareholdings as a source of funds for such strategies, and the enhancement of shareholder returns, and disclosed these discussions together with our Medium-Term Management Forecast. We also discussed initiatives for sustainability management and promotion of human capital management from a long-term perspective.

| Resolutions/Approvals |

- Approval of quarterly financial results, approval of annual and semi-annual budgets, appropriation of surplus, interim dividends, and revision of business performance forecasts

- The Board of Directors shall submit to the General Meeting of Shareholders a proposal for the election of directors and corporate auditors, approve the notice of the Annual General Meeting of Shareholders, select representative directors and executive directors, appoint directors in charge, select members of the Nomination and Compensation Consultative Committee, and determine monthly monetary compensation for each individual director.

- Monitoring of the Medium-Term Management Forecast, reduction policy regarding the holding of specific investment securities, sale of securities holdings, change in shareholder return policy (introduction of DOE index), and selection of market segments

- Responding to shareholder proposals from major institutional investors, etc.

|

| Matters to be reported |

- Monthly, quarterly, and annual financial reports, review of corporate governance reports (Japanese only), results of evaluation of internal control systems for financial reporting, report on Sustainability Committee activities, CDP climate change report responses, evaluation of board effectiveness, status of dialogue with institutional investors, etc.

|

Assessing Board Effectiveness

Once a year, the Board of Directors analyzed and evaluated the effectiveness of the Board of Directors, taking into account the self-evaluations of each director and each auditor, etc. The methods and results of the evaluation of the effectiveness of the Board of Directors for the year ended March 31, 2024 are summarized below.

A questionnaire was distributed to all directors and corporate auditors regarding the effectiveness of the Board of Directors, and an analysis of the effectiveness of the Board was conducted based on their responses. The questionnaire was a combination of a 5-point scale and qualitative evaluation based on comments.

The questionnaire covered nine items, including the role and function of the Board of Directors, its operation, and medium- to long-term management issues. Please refer to our report on corporate governance submitted on June 25, 2024 for details of the items.

The results of the questionnaire showed improvements in the quality, timing, and other aspects of the prior distribution of materials, for which room for improvement was recognized last year, as well as in the accessibility of information for outside directors.

The size and composition of the Board of Directors and the operation of the Board of Directors were rated as appropriate. While the company is taking appropriate measures with respect to relations with investors and shareholders, there was room for improvement in the dissemination of information. Furthermore, further discussion is needed on measures to enhance corporate value and medium- to long-term management issues, and we plan to increase the weight of these issues in the future.

Officer

Reason for Appointment

Board member

Audit and Supervisory Board

Skill Matrix

The skills matrix has been revised and "Capital Management" has been added.

Training

When welcoming outside directors and outside corporate auditors to the Company, we provide them with training to acquire the necessary information on the industry to which they belong, the Company's history, business summary, financial information, and so forth, including a tour of the Company. In order to acquire the knowledge and information necessary to fulfill their expected roles and responsibilities, directors and corporate auditors participate in outside seminars, external organizations, and exchange meetings with other companies. Expense for such training is borne by the Company in accordance with internal regulations upon the request of Directors and Corporate Auditors.

Risk management

The Company has established the following systems to ensure that the execution of duties by directors and employees is in compliance with laws, regulations, and the Articles of Incorporation, and to comprehensively identify short- and long-term business-related risks, take all possible countermeasures, and steadily implement risk management.

- One director will be selected by the Board of Directors as the "Director in charge of Risk Management".

- The Sustainability Committee, consisting of directors, corporate auditors, employees, and compliance officers, has been established to improve and enhance the risk management system.

- The Sustainability Committee deliberates on important issues with the aim of enhancing corporate value over the medium to long term through sustainability management, and assigns managers to each of the E (Environment), S (Society), G (Corporate Governance), and X (Special Missions) subcommittees. The Company's Sustainability Subcommittees are responsible for governance, risk management, strategies, indicators, and targets, and formulate, manage, and evaluate the progress of these activities based on the "Sustainability Policy.

- The Sustainability Committee determines who will be responsible for the execution and management of each important risk item, which is determined based on the results of risk assessment by the Sustainability Committee, and determines and implements response policies based on the Risk Management Policy (including the Crisis Management Policy).

- The Sustainability Committee also reconstructs the BCP (Business Continuity Plan) for raw material procurement, sales, and logistics in anticipation of geopolitical risks as the occasion demands.

Ensure compliance

We believe that maintaining and strengthening the compliance system (including legal compliance) and the supervisory function over management is fundamental to corporate value and essential to achieving long-term sustainable growth, and have established the following systems

- The Compliance Officer shall report to the Board of Directors on the status of compliance with ethics and laws and regulations.

- The Company shall establish and operate an internal reporting system with the General Manager of the Corporate Planning Department and the legal advisor as the reporting contact points.

- The Internal Audit Office, which is independent from the executive departments and directly reports to the President, will conduct periodic internal audits to ascertain the status of the execution of duties and verify whether they are being performed properly, appropriately, and rationally in compliance with laws, regulations, the Articles of Incorporation, and other relevant laws and regulations. The results of such audits shall be reported to the Board of Directors and the Board of Corporate Auditors and, as necessary, to the Accounting Auditor.

- As a business operator handling personal information under the Act on the Protection of Personal Information, we recognize the necessity and importance of protecting personal information and consider it our social responsibility to ensure the protection of personal information. With the aim of ensuring the proper handling of information assets including personal information, we have established a privacy policy and thoroughly protect personal information in terms of organizational safety control measures, personnel safety control measures, physical safety control measures, technical safety control measures, and understanding of the external environment.

Initiatives in the Medium-Term Management Forecast

We have established the following as our main goals and specific themes for governance initiatives.

- Strengthen management monitoring

External directors and executive divisions will work together to promote corporate governance.

- Disseminate information to stakeholders and strengthen communication

We will provide corporate information on our business model, business performance, and business strategy to investors through research firms. At the same time, we will enhance IR activities for institutional investors.

- Information Security

We maintain an information security environment that addresses the latest cyber attacks and information leak risks.

Click here for information on the Medium-Term Management Forecast